The 8th world wonder and the habit of saving make us soon “rich in time”. Oscar and I show how saving and compounding have a positive effect on each other and increase the chill factor – may be the 9th world wonder?

The 8th world wonder and the habit of saving make us soon “rich in time”. Oscar and I show how saving and compounding have a positive effect on each other and increase the chill factor – may be the 9th world wonder?

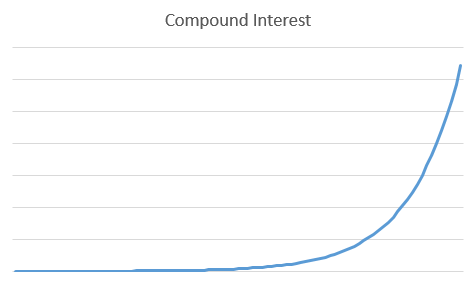

The 8th world wonder – this is how Albert Einstein described compound interest. And why? Probably due to the fact that the human brain has trouble imaging exponential growth. And this is exactly what happens with finances and compound interest – accruing interest is reinvested and the wheel turns. The longer it turns, the more effective the compound interest effect becomes.

Actually, every child knows that (learned at school), but only a few can imagine it and many less can make use of it.

The curve remains flat for a long time, but suddenly it rises, and how – that’s probably what the smart ones mean when they say that they let their money work. And this is exactly the trick we use to become “rich in time”.

But Oscar and I want to benefit even more from this compound interest effect – that’s why we combine the compound interest effect with savings.

If we combine compound interest with our savings rate, we get some interesting insights.

We love to dream and experiment. We know the compound interest effect and we also enjoy saving. Every month we save something and invest it at a certain interest rate. Now we ask ourselves how long we have to save and invest with specific savings rates and interest rates until we have covered our annual income, e.g. wage/salary, with the annual interest amount (before deducting the savings portion, we want to save also in the future, because saving is a matter of habit). So, we ask ourselves, from which year on we are free and “rich in time”.

Monthly savings rate:

10%

20%

30%

The interest that our investments yield:

Annual 5%, equals 0.42% monthly

Annual 10%, equals 0.83% monthly

Annual 15%, equals 1.25% monthly

Annual 20%, equals 1.67% monthly

Results – After how many years does our interest income at least equal our annual salary?

| Parameters | Years |

|---|---|

| 10% savings rate, 5% annual interest rate | 18 |

| 20% savings rate, 5% annual interest rate | 13 |

| 10% savings rate, 10% annual interest rate | 12 |

| 30% savings rate, 5% annual interest rate | 11 |

| 20% savings rate, 10% annual interest rate (or 10% savings rate, 15% annual interest rate) |

9 |

| 30% savings rate, 10% annual interest rate (or 10% savings rate, 20% annual interest rate) |

8 |

| 20% savings rate, 15% annual interest rate | 7 |

| 30% savings rate, 15% annual interest rate (or 20% savings rate, 20% annual interest rate) |

6 |

| 30% savings rate, 20% annual interest rate | 5 |

Logically, who would have expected anything else, it takes the shortest period of time when the savings rate and the annual interest rate are at their highest. With this setup, after 5 years, the annual interest amount would correspond to the annual income.

And since saving is easier than generating a high annual interest rate, we preferred the variant with a higher savings rate when two possibilities led to the same result.

What is also very interesting in our eyes is the fact that with a savings rate of 30% and an annual interest rate of only 5%, the interest income covers your income after only 11 years.

We realize that this is a pretty simple model – but hey, we’re not complicated and we don’t like anything complicated. It should be simple, and easy to implement. For us, we have illustrated that it is possible to get “rich in time”… that’s why we are clapping our hands and investing in practice – trying to save even more than 30% and reach the annual interest rate of 20% – exactly as defined in the targets.

Leave A Comment