Oscar and me, we are building three money pools. One pool “Life”, one pool “Buffer” and one pool “Work”. We will divide our assets into these pools in the ratios 10%, 20%, and 70%.

Oscar and me, we are building three money pools. One pool “Life”, one pool “Buffer” and one pool “Work”. We will divide our assets into these pools in the ratios 10%, 20%, and 70%.

That way, we will let our assets work for us and enjoy life – we will be rich in time.

Furthermore, you will get to know the factor 1.4 and the overdrawn 20%.

Oscar and I have roughly defined what we want to save until the year 2023.

The goal is to build up a total wealth so that it is big enough to work on its own – in other words: our money works (almost) alone and we become rich in time.

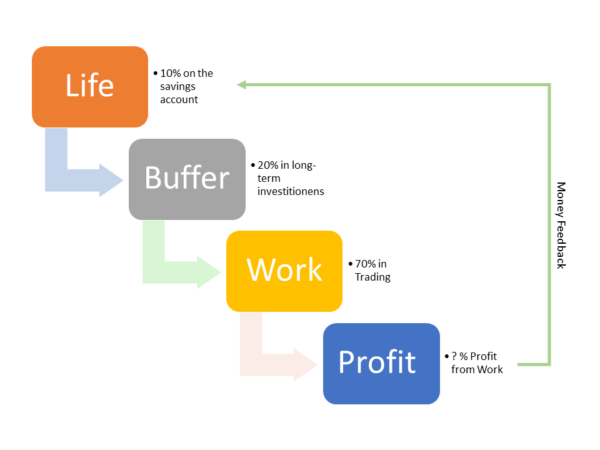

The total assets are to be divided into so-called 3 pools as follows:

- Life: 10% on the savings account

- Buffer: 20% in long-term investments (passive)

- Working: 70% in trading (active money management)

The whole thing is a first draft – we can well imagine that our savings goal will be adjusted and optimized over time. We never stop learning and Oscar certainly has one or two cool ideas in his quiver.

Why this division into three pools?

Each of these 3 pools has its task.

Pool 1: “Life”

Pool 1 “Life” is, as the name suggests, for life – for the daily life, for everyday life. Or also our income – you only spend what you have. No debts. The credit advertising should be forbidden anyway! Even before the advertisement for cigarettes!

Pool 2: “Buffer”

Pool 2 “Buffer” is a crumple zone for unforeseen events and emergencies.

Pool 3: “Work”

Pool 3 “Work” secures our future life. The money works for us and we support it with minimal effort.

The flow of water respectively of money between the pools

The following graphic visualizes the cash flow simplified. The cash flow is triggered once or twice a year. The description of the details follows the graph.

Basically, this cash flow is a cycle – when the lowest pool is full, the excess flows into the highest pool and from where the money flows back down again.

I start with the explanation in the middle: In the pool “Work” the money is working for us. At the end of the year a profit or our income is generated from this. The profit flows back into the pool “Life” at the end of the year until this pool makes up 10% of the total assets again. Further funds then flow into the pool “Buffer” until the 20% is reached. The rest flows back into the pool “Work”.

That the cash flow can start and our life can be financed according to the objectives, the total assets reached by us in 2023 should be divided between the 3 pools. Important: the original amount of money in the pool “Work” must never be undercut.

Now there are actually 2 variants how the money flow can look over time. However, only one variant is valid for us, but in the following, both will be considered briefly.

Cash Flow Variant 1: High Risk – Return to Consumerism

The money in the pool “Work” is increasing for us. At the end of the year, we add up all pools including the profit and divide them into 3 parts of 10%, 20%, and 70%. Thus all 3 pools increase and we have more money for “life”. Yay, we can consume more, how awesome!

Example Variant 1:

Initial year:

- 10%: 20’000.00

- 20%: 40’000.00

- 70%: 140’000.00

- Profit: 0.00

End of the year before cash flow:

- 10%: 0.00

- 20%: 40’000.00

- 70%: 140’000.00

- Profit: 28’000.00

End of year after cash flow/beginning of next year:

- 10%: 20’800.00

- 20%: 41’600.00

- 70%: 145’600.00

- Profit: 0.00

Great, 4% more to live and spend!

Cash Flow Variant 2: Cool – Rich in Time

The money in the pool “Work” is increasing for us. At the end of the year, we take the profit and fill the pool “Life” with the original amount which made 10% at the start. The rest goes back to the pool “Work”.

Example: Variant 2:

Initial year:

- 10%: 20’000.00

- 20%: 40’000.00

- 70%: 140’000.00

- Profit: 0.00

End of the year before cash flow:

- 10%: 0.00

- 20%: 40’000.00

- 70%: 140’000.00

- Profit: 28’000.00

End of year after cash flow/beginning of next year:

- 10%: 20’000.00

- 20%: 40’000.00

- 70%: 148’000.00

- Profit: 0.00

Great, more than enough money to live and our working capital is increasing – so we are well cushioned for lean years where the work might be a little less – for our money, not for us, we do not work ;).

For the sake of simplification, we have not considered emergencies and possible profits from the buffer in the two variants. Since we invest this pool passively, even some profits will appear sometimes which will be reinvested again – kind of a double buffer.

Additional protection, factor 1.4

With the objectives, it was also defined that the working money should yield an average annual profit of 20%. This 20% should represent approximately 1.4 times the amount needed for life. The inclined reader has surely recognized this in the above examples. In the diagram, the percentage amount was consciously represented as ?, since these 20% profits per year symbolize an average value over several years.

But the factor 1.4 is nevertheless a protection – on the one hand, if our 3rd pool doesn’t work so well, hopefully, we still reach the amount for the pool “Life”. On the other hand, it could be that you are in need of a little more funds – in that case, we have the factor 1.4 and the pool “buffer”.

However, and this is the master plan: If everything goes according to plan, we can be sure that our working pool will become stronger and will yield more and that our general padding will grow for the hard winters.

And last but not least it gives us the opportunity to do good, to give away in the form of donations and to help others.

The Difference

The FIRE Community is more into passive investing. I think that’s ok, but it has one big disadvantage: The required initial capital. If we assume an annual profit of about 7%, we would need about twice the initial capital, i.e. 400,000, instead of 200,000, as in the examples above.

These are only examples, everyone has to convert the amounts to his own situation.

I hear the whiner and no-sayers already… “mimimimi… but I don’t want to deal with my money and… mimimimi… 20% is overdrawn anyway”.

Dealing with money

With everything that is important to you, you occupy yourself – with your family, with friends, with your health you take care of and even for years with your job (when you love it, superduper… do you see the hint?). But you do not want to deal with money? Not even a few minutes a week to gain control and to win your life?

20% are overdrawn

Why? Just because? Just because the so-called financial experts say so? Or simply because you believe it?

Of course, it is overdrawn!

It’s overdrawn if you think it’s done with 5 minutes of initial effort – learning and studying is the order of the day.

Of course, it is overdrawn!

It is overdrawn if you think, once you get the hang of it, nothing more to do.

Of course, it is overdrawn!

It is overdrawn if you think you’ll be a millionaire in 30 days.

Of course, it is overdrawn!

It is overdrawn if you think that money is bad.

Of course, it is overdrawn!

It is overdrawn if you think that it is overdrawn.

Of course, it is not overdrawn if you are willing to make an initial effort, if you’re willing to spend a few minutes each week, if you are willing to open up and stand up for your dreams.

Finally

Maybe you want to know how big your total assets should be to make this model work for you (even if you don’t yet know how to achieve 20% profit a year… don’t worry, that’s yet to come)?

In the tools section, you will find a download that helps you to calculate your total wealth based on your annual life budget. Or you simply look at how big your pool “life” would be at the moment if you split your total assets among the 3 pools.

Tell us your thoughts… how would you make use of your savings? And do you stand up for your dreams? And how?

Leave A Comment